26+ Actual mortgage calculator

But with a bi-weekly mortgage you. P the principal amount.

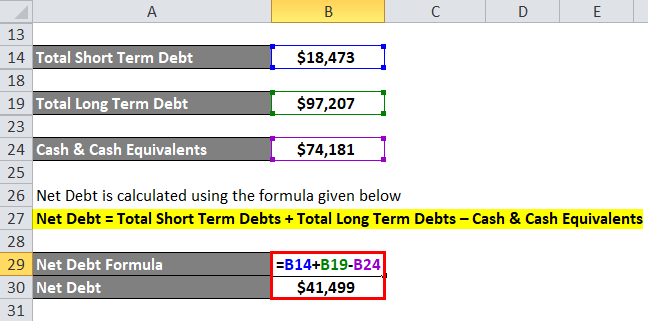

Net Debt Formula Calculator With Excel Template

Where n is the term in number of months PMT.

. Use our free mortgage calculator to estimate your monthly mortgage payments. The mortgage payment estimate youll get from this calculator includes principal and interest. Interest Rate based on the annual percentage rate APR 3.

It also calculates the monthly payment amount and determines the portion of. Generally lend between 3 to 45 times an individuals annual income. Your APR is derived by combining your total mortgage costs into the principal.

Adding Subtracting Time. The Mortgage Amortization Calculator provides an annual or monthly amortization schedule of a mortgage loan. Loan Term In the drop down area you have the option of selecting a.

Most home loans are structred as 30-year loans which is 360 monthy. The Mortgage Payment Calculator allows you to calculate monthly payments average monthly interest total interest and total payment. Our free mortgage calculator is here to help simplify the process of choosing the best mortgage for you.

It helps you understand what factors affect your mortgage payment so that you can be. A mortgage has three primary components that determine your monthly payment. Are you starting biweekly payments in a middle of a loan schedule.

M monthly mortgage payment. Use Zillows home loan calculator to quickly estimate your total mortgage payment including principal and interest plus estimates for PMI property taxes home. Well use the calculator above to determine the effective APR of our next example.

Mortgage lenders in the UK. Principal this is the loan amount 2. Account for interest rates and break down payments in an easy to use amortization schedule.

Your lender likely lists interest rates as an annual figure so youll need to divide by 12 for each. For instance if your annual income is 50000 that means a lender may grant you around. If you choose well also show you estimated property taxes and homeowners insurance costs as.

P M T P V i 1 i n 1 i n 1. So if your. So if you paid monthly and your monthly mortgage payment was 1000 then for a year you would make 12 payments of 1000 each for a total of 12000.

Monthly mortgage payments are calculated using the following formula. Your lender likely lists interest rates as an annual figure so youll need to divide by 12 for each month of the year. Remember your actual mortgage rate is based on a number of factors including your credit score and debt-to-income ratio.

I your monthly interest rate. P the principal amount. I your monthly interest rate.

Bi Weekly Budget Budget Planner Template Weekly Budget Template Weekly Budget Planner

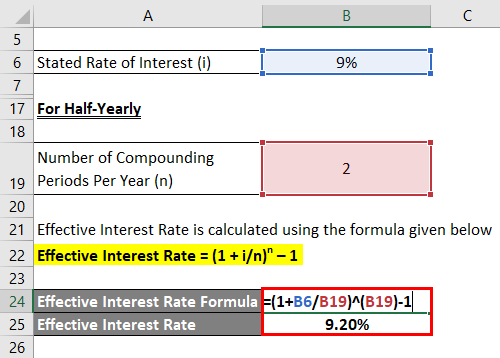

Effective Interest Rate Formula Calculator With Excel Template

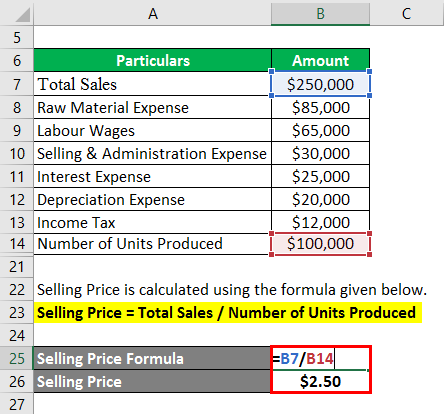

Profit Formula Calculator Examples With Excel Template

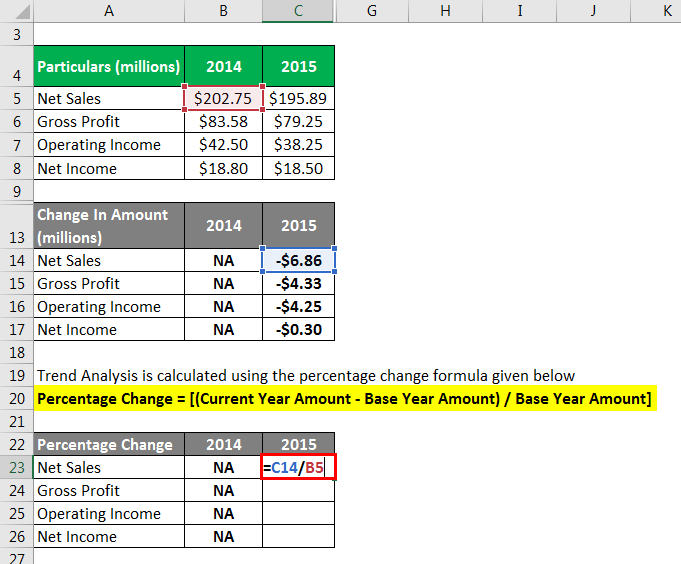

Trend Analysis Formula Calculator Example With Excel Template

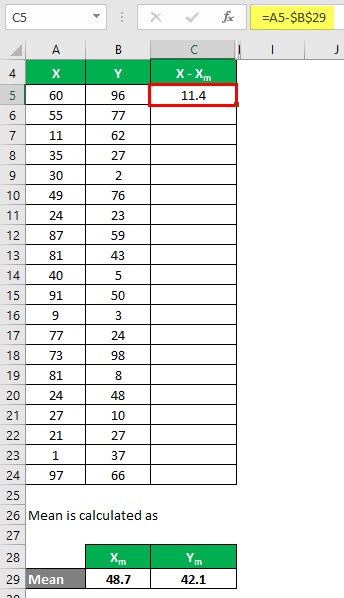

Coefficient Of Determination Formula Calculation With Excel Template

Personal Budget Planning Template Fresh Free Bud Spreadsheet For Mac Personal Bud Household Budget Template Budget Template Printable Simple Budget Template

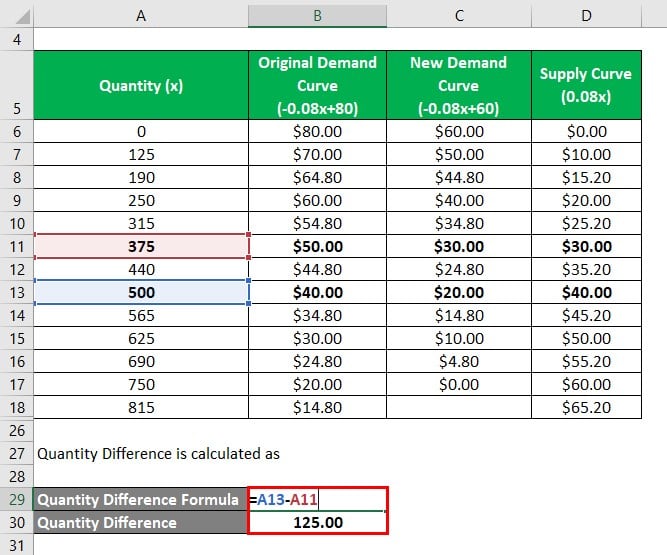

Deadweight Loss Formula How To Calculate Deadweight Loss

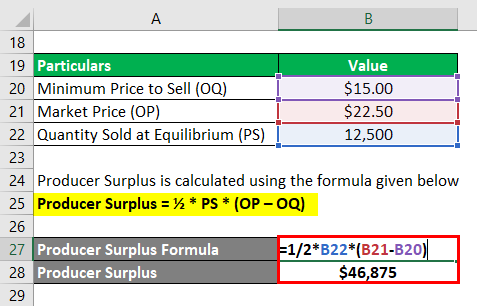

Producer Surplus Formula Calculator Examples With Excel Template

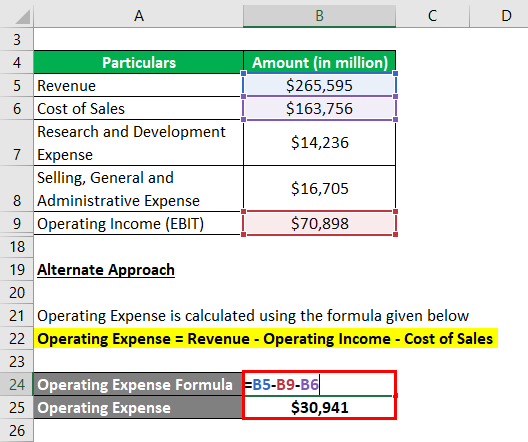

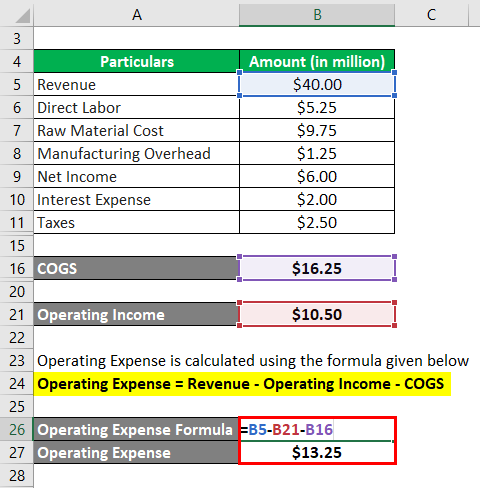

Operating Expense Formula Calculator Examples With Excel Template

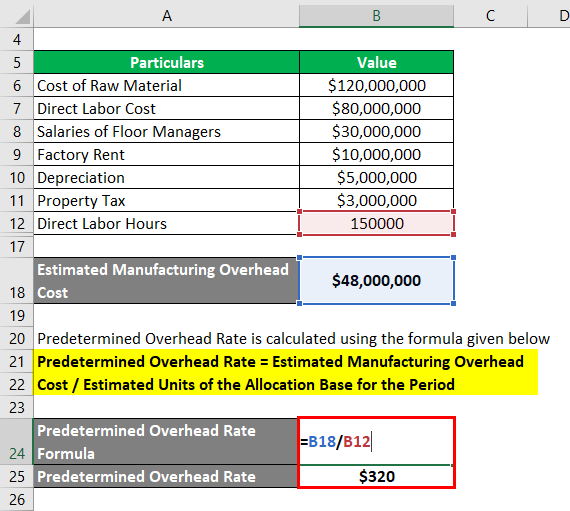

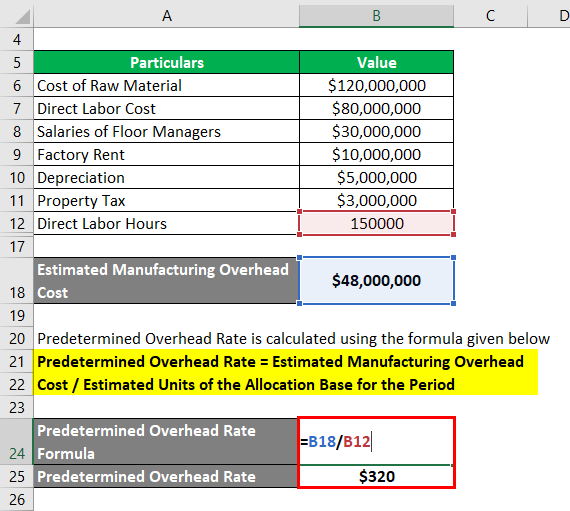

Predetermined Overhead Rate Formula Calculator With Excel Template

Reserve Ratio Formula Calculator Example With Excel Template

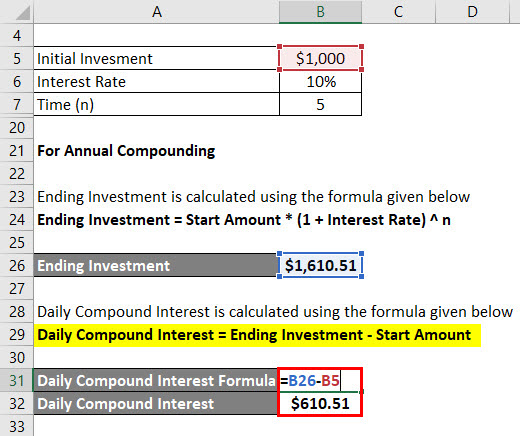

Daily Compound Interest Formula Calculator Excel Template

Maturity Value Formula Calculator Excel Template

Effective Interest Rate Formula Calculator With Excel Template

Operating Expense Formula Calculator Examples With Excel Template

Loss Ratio Formula Calculator Example With Excel Template

Perpetuity Formula Calculator With Excel Template